Fox Financial Planning Network is now AdvisorTouch

The AdvisorTouch platform integrates ready-to-use scalable workflows, best practices, and recommended technology solutions to help your firm achieve growth and scalability without the painful experience of doing it on your own.

Solutions for Every Type of Financial Organization

Advisors

Every firm is unique, but each firm can benefit from systems and documented processes. AdvisorTouch provides a platform to streamline your delivery of financial services.

Operations

Creating satisfied clients begins with an efficient Operations Team. Add internal processes that have been created, tested, and implemented by some of the industry's biggest names.

Institutions

Implement a systematic, scalable program for every advisor on your platform to create company-wide harmony and set up your organization for decades of sustained growth.

Technology

Companies

Lean on our industry knowledge and experience to step forward into your future and make sure your company is on the right path to creating what advisors truly need.

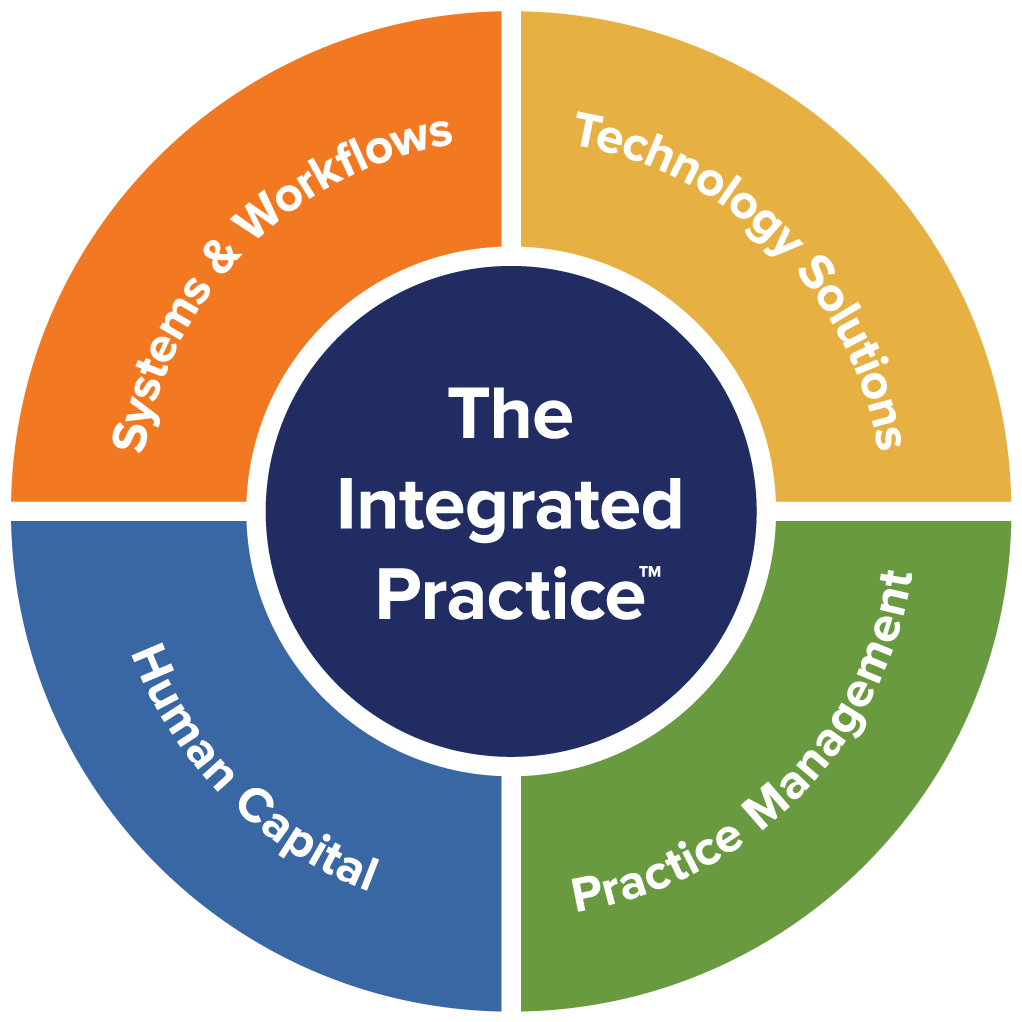

The AdvisorTouch Platform

Create a higher level of client service with ready-to-implement systems you can use to build your financial planning business. The AdvisorTouch platform provides all the training, tools, materials and resources you need to drive internal efficiency, add revenue, and increase client satisfaction.

What Makes Us Different?

AdvisorTouch is the only platform that delivers a complete integrated system to scale every area of your practice with personalized training, practice management resources, coaching, and community to help you achieve balance in your business. You could try to build your own processes, but why go to the trouble when we've already created a proven system that gets results? We'll guide you every step of the way to building the practice you've always wanted to create.